Consumerism Tips for Medical/Dental Debt/Collections Reporting to Collection Bureaus

Article by: Pam Huntington

Employee Benefits Specialist – CU Insurance Solutions

I have been in the health insurance arena for many years now, but in one of my prior roles, I was a Collections Manager at a credit union. It was staggering to see the amount of credit reports with medical debt collections. The stark reality is all of us are only one sickness or accident away from needing our health insurance benefits.

With the rising cost of care and health insurance deductibles, we could be faced with large out-of-pocket expenses. In a recent article from Benefits Pro regarding health care debt, it states that in the past five years more than half of U.S. adults reported they’ve gone into debt because of medical or dental bills. 100 million people in U.S. saddled with health care debt | BenefitsPRO

There are some options, and one we are seeing more folks doing is applying for Care Credit. I know my family has personally used this for larger-than-expected orthodontia care. Care Credit often allows you up to 24 months of interest-free payments, and you can set those payments to automatically pull from your Health Savings Account (HSA).

A helpful consumer tip with Care Credit. Their monthly statements can be a “little tricky” as they continually show a lower amount due after a payment has been made. It could be tempting to just pay the minimum payment each month but at the end of the term you may not have paid your balance in full. Consequently, you could end up owing interest charges on your entire initial balance at rates in the 20%+ range!

If you find you have a debt that has gone to a collection agency, here are some tips that can help you navigate the process. First, keep the communication lines open with the collection agency and often you will find the outcome will be better. The collection agency does reserve the right to place the account on the consumer’s credit report. As the consumer, you can always ask the collection agency to keep the account from being reported to the credit bureaus while you are in repayment as a term of repayment. The collection agency, however, is under no obligation to do so. Remember, the answer is always no unless you ask the questions.

If the collection agency reports the medical collection to the credit bureau, the consumer has another option available to them. Once they pay the account in full, they can ask the collection agency to remove the account completely from their credit report. Again, the collection agency is under no obligation to do so, but I have found many are willing to do this once the account is paid. You may soon have some medical debt wiped from your credit report: Here’s why (msn.com)

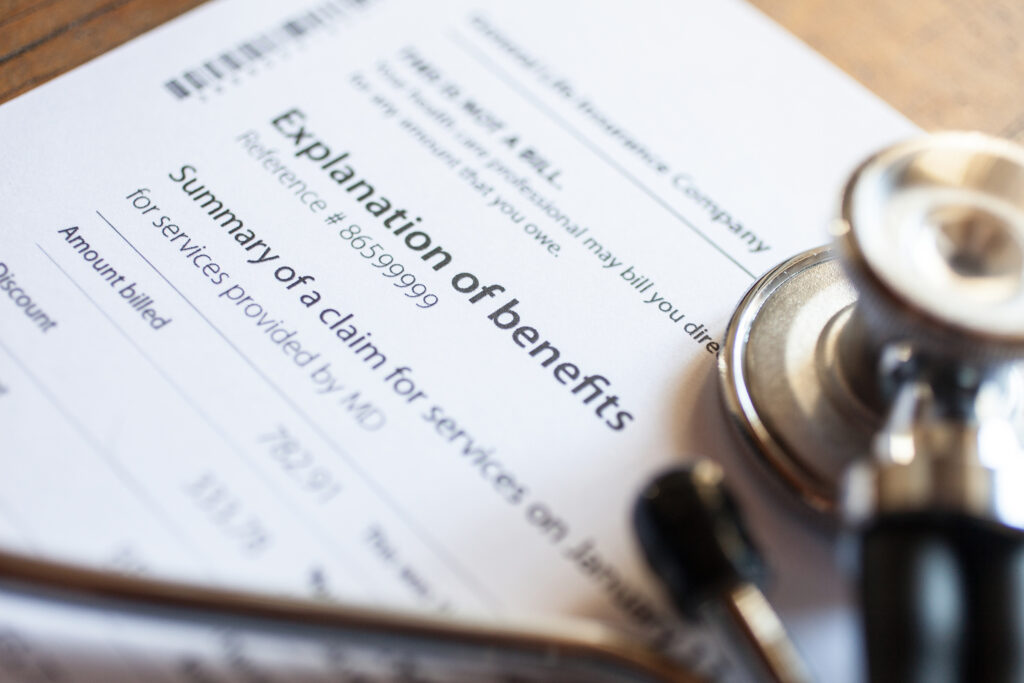

As always, make sure you are reviewing the bills you receive from your providers to be sure they match what the carrier states is your responsibility on your Explanation of Benefits (EOB). Your Employee Benefits Team is always happy to help review these with you.

Back to School Health Advocacy

Article by Elizabeth Ingram

Vice President of People Strategy, CU Insurance Solutions

Don’t get me wrong, we’re all thrilled that school has shifted back to normal – full-time! Field trips! However, the paperwork!

Keep in mind that as a parent, you need to advocate for your kid and both daycares and schools require copies of up-to-date immunizations as a starting point. To make things a bit easier on yourself, here are a few tips.

Check state law or check with your child’s primary care physician (PCP), well in advance of starting school, to see what immunizations are required for public school to make sure you won’t have any enrollment issues.

Every time your child gets a shot at a well-child visit, ask for 2 copies of their updated immunization sheet then & there. Bring one home and file it, but immediately put the second set into your child’s school bag with a sticky note for the appropriate person. If you are at a flu clinic or such, you may not be able to get the updated record right away, but typically flu shots aren’t required in schools, so this probably won’t be an issue.

Remember that most school forms need to be updated annually. If you can, plan ahead because doctors’ offices get inundated with requests for forms as school and sports start up. Often you can request the forms you need through a patient portal if your children are young; otherwise, give the office a call.

If your child has special needs: mental, physical, allergies, or behavior, you’ll want to make sure that you have a meeting with the appropriate team as school gets started as most individual plans get updated each year. Make sure you notify the school of any special needs before school starts but don’t expect to have a meeting until at least a few weeks into the school year. It doesn’t mean your child won’t be cared for in the meantime, but a formalized plan might have to wait. You will want to make sure that if your child has an allergy, their teacher is aware, and the classroom is free of the allergen if need be.

If your child needs specialized medicine to keep at school, for example, epi-pens, plan ahead. Your insurance might only allow you to fill one prescription within a certain time frame, and you need to be sure your medications at home are filled too. I generally request refills in late July if I need them for an early September start. Make sure you get the prescription your child needs and don’t be afraid to educate pharmacists or nurses if you’re confident (in a nice & polite way). I’ve found that many people don’t know that you aren’t supposed to separate the 2 epi-pens that come in a pack because you may need the second one if there is a secondary reaction over the course of the next 24 hours or a particularly severe reaction that doesn’t react to the first pen; you need 2 sets of epi-pens (1 for home & 1 for school), NOT to 2 epi-pens.

Check with your school nurse to determine the best way to send in medications and what other information to include: original packaging, an updated asthma plan, etc.

The school may have other forms you can choose to complete, so make sure you read all the paperwork emailed to you or sent home. For example, in our district, we always have the option to opt-in to allow the nurse to provide certain OTC medications as needed. Choose what works for you.

Lastly, remember your child’s PCP and the school are working with you to keep your child cared for, but you are the advocate. Don’t be afraid to use your voice to ask questions and educate, and encourage your child to do the same.

Health Savings Account (HSA) – Facts, Questions and Misconceptions

Article by: Heather Baird

Account Manager – Employee Benefits, CU Insurance Solutions

As employee benefits consultants and educators, we receive many questions in relation to Health Savings Accounts (HSA). Here are some common questions, as well as lesser-known facts and misconceptions, you’ll want to be aware of when offering and utilizing an HSA.

First and foremost, if the coverage for an employee’s High Deductible Health Plan (HDHP) is effective any day other than the first of the month (i.e. date of hire- DOH) an HSA cannot be opened until the first day of the following month (i.e. DOH = April 15th– HSA effective date = May 1st).

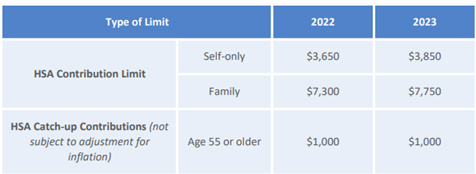

Once an HSA is established, employees will need to determine their contribution amounts. HSA contributions are established annually by the IRS. If an employee and spouse are on two separate HDHP and both contribute towards an HSA, they cannot exceed the combined family maximum. It’s commonly misunderstood that one parent with dependents can contribute the family maximum and the spouse on a single plan can contribute an individual maximum. This is NOT the case. $7,300 is the maximum family limit for a taxable family unit in 2022. This includes all employee and employer contributions. Additionally, if an employee changes employers and plans mid-year and opens a new HSA, their annual maximum contributions will include contributions from all HSAs, not to exceed annual maximums.

That being said, under the last-month rule, if an employee becomes newly eligible on the first day of the last month of his or her tax year (December 1st for most people), they are treated as having the same HDHP coverage for the entire year as is in place on the first day of the last month. This allows employees to contribute the maximum limit. Note, contributions can be made up to April 15th of the following year (applies to all HSAs). If an employee fails to be an eligible individual during the year, they can still make contributions until April 15, for the months they were an eligible individual at the prorated amount.

If an employee decides to take advantage of this rule, they must be aware of the Testing Period. If they fail to remain an eligible enrollee (enrolled in a HDHP) through the subsequent 12 months (i.e. December 1, 2021, through December 31, 2022) they will be subject to a 10% additional tax.

Notes on dependents

An employee’s dependents do not need to be covered under their HDHP to utilize HSA funds. Employees may use HSA funds to pay for medical, dental, and vision costs for taxable dependents not covered under their plans.

So, what if your dependents aren’t taxable? Under the ACA, medical plans must allow dependents up to the age of 26 on the plan, but if a dependent is enrolled under their parent’s HDHP and filing their own taxes, they are not eligible to utilize their parent’s HSA funds. This qualifies a non-taxable dependent to open and contribute to their own HSA. Because the dependent is covered under a family qualified HDHP, they are eligible to contribute the family maximum $7,300 (2022). There are no limits on who can contribute to an HSA, so if a dependent is financially unable to, a parent or loved one can contribute to the account on their behalf post-tax. One important note, the funds in this HSA can only be used for this dependent’s out-of-pocket medical expenses. They cannot use them for any of their spouse or taxable dependents’ costs.

Employees need to keep in mind if they go from Employee + Child or Family coverage to Single coverage mid-year contributions need to be adjusted accordingly.

Medicare and HSAs

As employees near age 65 and Medicare eligibility, they need to be aware of HSA rules. There is a six-month retroactive Part A coverage period. Retroactive coverage in Medicare Part A occurs as follows:

- Enrollment in (premium-free) Part A coverage within six months of turning age 65 will trigger retroactive Part A coverage that is effective the month the employee turns 65. (If the person’s birthday is the first of the month, coverage will start the month before he or she turned 65.)

- Enrollment in (premium-free) Part A more than six months after turning 65 will make Part A coverage retroactive for six months (but no earlier than the month one turns 65).

Employees need to determine in advance when they are going to enroll in Medicare then stop making HSA contributions in the preceding six months.

Also note, starting at age 55 the IRS allows an additional $1,000 annual “catch-up” contribution, and at 65 individuals can withdraw HSA funds for any purpose without penalties, if taken out for expenses other than medical income tax will be applied.

If you have specific HSA questions, we recommend you reach out to your tax advisor for guidance.

Kids and Insurance

Article by Heather Baird

Employee Benefits Account Manager

CU Insurance Solutions

In the past few years, I’ve come to the epiphany of how important taking care of my mental health and wellbeing is in relation to my children and parenting. As a working parent, I’ve many times been overwhelmed with guilt. As a result, I’ve overcompensated with an abundance of love and attention, many times to the detriment of my own wellbeing.

Within our crew of buckaroos, we have various diagnoses including sensory processing disorder, ADHD, and anxiety. The past two years have been a whirlwind of assessments and specialist visits. Through the guidance of a wonderful team of specialists, aka “Team Baird”, and the support and advice of other moms, I’ve learned so much not only about each of these conditions and my kids, but about myself.

Dealing with the above in itself is overwhelming, but then add in the stress and complexity of paying for all of this, and it can feel insurmountable. If you know your child is going to need services in a coming year, you’ll want to review your plan options (multiple employer plans and/or a spouse or partner’s plans). Some things you’ll want to consider are out-of-pocket (OOP) maximums, specialist copayments, specialist visit limits, and HSA compatibility.

When reviewing your plan options instead of looking at a plan’s deductible you need to look at your maximum exposure, or maximum OOP limits. In most cases, an expensive procedure or a treatment plan with multiple specialists will result in you meeting a plan’s OOP maximum. This will be vital in planning and budgeting.

You’ll also want to see if the plan(s) offers copayments for specialist visits or if the costs go fully towards deductible and coinsurance. Keep in mind, copayments DO NOT go towards your deductible.

If you have a child who needs multiple therapy services (speech and occupational therapy), there is usually a limit per year. You’ll need to work with your providers to coordinate benefits, so you don’t exceed the maximum each year. In our case, we alternated specialists every other week. Most plans do not have a mental health maximum.

You will also want to review HSA options. Look at employer HSA contributions and the maximum family contribution limit versus the plan’s OOP maximums. HSAs are a way to save and budget for services with tax savings.

Finally, check with your employer regarding your Employee Assistance Programs (EAP) for 24/7 support, advice, and resources. Remember, each family is different, so what works for mine may not be the best plan for you. Talk to your HR director or employee benefits’ educator. We are resources to help you find the best benefits to match your family’s needs.

I want to end with a word of encouragement. Personally, I’ve blamed and shamed myself over my children’s diagnoses and struggles. Am I a perfect parent? Absolutely not! But that doesn’t mean this is my fault. I’ve had to come to a place of acceptance in my life that this is just what it is, and in that there is a freedom to move forward, learn, grow, and share what I’ve been given. We can’t always control our circumstances, but we do have a choice about how we react to them.

“The most profound personal growth does not happen while reading a book or meditating on a mat. It happens in the throes of conflict- when you are angry, afraid, frustrated. It happens when you are doing the same old thing and you suddenly realize that you have a choice.” ~Vironika Tugaleva

Below are several resources that have helped in our journey.

- The Highly Sensitive Person (hsperson.com), The Highly Sensitive Child | Helping parents understand and appreciate their highly sensitive children

- In & Out (1997) – IMDb – this is a great movie to watch with your kids to get the conversation started about feelings

- A Little SPOT Series – Diane Alber

- The Feelings Series — Trace Moroney

- Stop, Breathe & Think Kids (stopbreathethink.com)

- Peaceful Parenting | Aha! Parenting (ahaparenting.com)

- ADDitude – ADD & ADHD Symptom Tests, Signs, Treatment, Support (additudemag.com)

Always Review Your Explanation of Benefits (EOB) Statements

Article by Sarah Nash

Training Director, CU Insurance Solutions

Do you understand those EOB (Explanation of Benefits) statements you get from your health insurance carrier? My health insurance carrier is Anthem. It’s a lot of information. There’s the service date, service, reason code, doctor charges, your discounts, due to your doctor (maximum allowed), Anthem paid, and then there’s the column of what you owe. Most people probably wish they had a secret decoder ring to help understand these statements!

Recently I received an EOB from my health insurance carrier. I saw two visits, on two different dates, that were for exactly the same thing within the same medical facility (Mercy Northern Light). One visit was zero cost to me, and one was $44.98. I thought that was a bit strange, so I called the insurance company. I spoke to a very helpful person who looked at both claims. She determined that one was coded strictly preventive, and one was coded Z392 which is preventive but had a post-partum notation. Huh? The one and only child I have had was born in 1994, and I don’t think post-partum pertains at this point in time. She told me to call Mercy Northern Light’s billing department. I spoke to another very helpful person who determined that because I already paid the bill, she’d have to transfer me to the Central Business Office of Mercy Northern Light to request a code review. I spoke to the helpful person there who sent my information in for a code review. Typically, you will get your EOB prior to your bill. This was not the case; I received the bill first. Because they offer you a small discount to pay before the due date, I take advantage of this when I am able.

I have not heard back yet whether the code review was changed in my favor or not. If it is not found to be in my favor, I do still have another option to try and get this remedied. I can appeal the claim. There are instructions on your EOB statement on how to file an appeal.

We often trust that these EOB statements are correct, and most of the time they are. Humans make mistakes, so this is just a reminder to look them over and if you have questions ask your health insurance carrier. Please also keep in mind that we are experiencing many examples of businesses being short-staffed. Patience is a virtue.

Beneficiary Updates

Article by Elizabeth Ingram

Vice President of People Strategy, CU Insurance Solutions

There are tasks that get put off because we don’t have time, those that we just don’t want to do, and those that we aren’t sure how to do. Beneficiary forms may feel like they belong in all 3 categories, but the reality is that they only take a few minutes to complete. They may not be fun to complete but can make a big difference in the event that something happens to you.

When I say beneficiary form, the first thing that comes to mind is life insurance (for you employers out there, consider reminding your staff to update beneficiary forms at your benefits renewal each year). However, retirement accounts, investment accounts, college accounts, and HSAs are all accounts that ought to have a beneficiary form on hand. If you aren’t sure about what you need forms for or how to get them, a good starting point is your employer and if you have one, your financial advisor.

Your employer probably has either the forms or links to access them for any employer-sponsored accounts and insurance (there may be multiple). Generally, they’ll request a copy of the completed beneficiary forms for their files; you should keep a copy for yourself in a safe place. Your financial advisor can do the same for any accounts through them.

Beneficiary forms should be updated whenever you have a major life event (marriage, divorce, children, name change, sometimes address changes, etc.). Updated beneficiary forms make the process of gaining access to your assets in the event of your death significantly easier for your beneficiaries and can help keep your household running at a time of great loss.

Lastly, consider keeping a list of any accounts or insurance in place that is known to your loved ones or advisors, so they can find the information quickly if need be.

As we celebrate Valentine’s Day this month, consider giving the gift of financial security to your loved ones.

Mental Health Healing Through Sharing & Connection with Others

Article by: Heather Baird

Account Manager – Employee Benefits, CU Insurance Solutions

As I began contemplating what to share here, my heart and head battled. What do I have that could make a difference? So, in the words of one of my favorites, Brene Brown, “vulnerability is not weakness; it’s our most accurate measure of courage.” Here it is, a raw and real expression of the realizations and truths I’ve learned about myself and mental health.

Mental health is a topic close to my heart. My mom has battled with her mental health my entire life. She experienced a traumatic event at four and has never worked through that trauma. The first time I became aware of the depth of her pain was in third grade. She was hospitalized. Through that experience, and the turn of events that followed, we never talked about it. I don’t remember one person asking if I was ok or how I was feeling. This pattern has repeated several times throughout my life.

My parents grew up in a generation where you just didn’t talk about these things. There’s a stigma around it. It’s the hidden secret we keep. We don’t want to air our “dirty laundry!” In my own journey, I’m realizing how many of us have believed those lies. What if instead of hiding it, we brought it out into the light? After all, when you bring darkness out into the light, it disappears, and I’m here to tell you from personal experience that’s where you can find true healing!

From conversations with friends, family members, and co-workers who have struggled, or have someone they love who struggles, with mental health, addiction, domestic violence, etc., there’s a common theme of embarrassment and shame. We all have our battles, friend. It doesn’t make yours better or worse, or more or less, than mine. What if in our vulnerability and honesty to both ourselves and the world, we not only find healing for ourselves, but maybe, just maybe, we can help lead others down a path of healing too. “We repeat what we don’t repair.” – Christine Langley-Obaugh

As we’re nearing the two-year mark of this pandemic, many of us are feeling the weariness that has set in. Distancing has kept us safe physically, but what effects has it had on our emotional, mental, and spiritual well-being? As humans, we’re social beings. We need each other.

Recently I heard someone say they’ve become more efficient since going remote. They don’t have the little interruptions throughout each day. This is so true, but what have we lost from those personal interactions? As an employer, I implore you to evaluate ways you can bolster connection amongst your team. Set aside time during the day where employees can connect on a personal level.

To end, I wanted to share an image that’s grasped my spirit and I can’t let go of. On September 11th, like many of you, my husband and I watched several documentaries and specials commemorating the 20th anniversary of that monumental day. During one of the programs, a survivor and the widow of a victim both echoed one thing. After September 11th, there was a sense of unity in our country. We were all Americans. There was no black or white. No red or blue.

I keep seeing the image of people emerging from the rubble that day. My heart feels like we’re in that same place of survival, but instead of emerging hand in hand, we’re alone. We’ve forgotten each other. What if we could put aside our differences and lift up our neighbors, co-workers, and communities in their time of need? The image. Survivors emerging from the debris, dust, dirt, and blood covered, but shoulder to shoulder, holding hands, lifting one another up. Out of the fall, we rise stronger. Be the change you want and need in your life.

Budgeting for the New Year

Article by Elizabeth Ingram

Vice President of People Strategy, CU Insurance Solutions

There are several situations that may warrant readjusting your budget: salary changes, benefit renewals, life changes (marriage, divorce, addition of a child, moves, etc.), and the start of a new (tax) year. Having a written budget that details your monthly income and expenses is a big help, but there are other considerations to keep in mind.

Tax Considerations

Dependent children, childcare, charitable deductions, and medical expenses can all impact what you pay in taxes. To get a rough idea of what you’ll owe in taxes for the year, you can visit the IRS Withholdings Estimator (Tax Withholding Estimator | Internal Revenue Service (irs.gov)). It isn’t available until early in the current tax year and you will need pay statements for yourself (& your spouse if you jointly file), but the 10 minutes you spend can help you maximize your income while minimizing your out-of-pocket expense at tax time. Go back and rerun the numbers when you have changes (including any bonuses you may receive).

Benefits Renewal

When your benefits renewal occurs, you may see increased costs for your medical, dental, vision, life, or other coverage. If you have a tight budget or like to plan ahead, keep in mind that what you pay in insurance premiums is often (but not always) pulled from your salary before taxes. Pre-tax premiums decrease your taxable income, so the decrease (or increase) in your take-home (or net) pay isn’t the same number as the premium cost. Post-tax premiums are pulled from your salary after taxes and do come out of your take-home pay at the same number as the premium cost. If you aren’t sure whether your premiums are pre- or post-tax, check with your HR department.

HSAs and 401Ks

Additionally, keep in mind that some benefits such as HSAs and 401ks have maximum contributions which increase each year. If you intend to maximize your contributions to this sort of benefit, be sure to take into account the increase each January.

Savings

Lastly, try to put some space in your budget to pay yourself (savings are hugely helpful when the unexpected occurs) and for any other priorities you may have for 2022.

The Importance of Health Insurance Transparency in New Positions

Article By: Trevor Pietila

Accounting Specialist

About 10 years ago, I gave my notice to a former employer, and during my exit interview, was given some great advice from the head of HR: “Make sure you don’t just leave for ‘more money,’ be sure you are looking at the total compensation package.” Being 22, I thought I had done enough due diligence: salary, retirement, short-term disability, vacation time. Everything looked great, until about 3 months in… I had to pick my health insurance plan. At this point, I truly understood what my former HR manager meant by “the total compensation package.” I was unfortunately met with a far less comprehensive plan with a higher deductible. At the time, being single with no dependents, it wasn’t really an issue, but looking at the employee+ children, and the family plan pricing, I realized that if my situation had been different, I would have unknowingly taken a pay cut, based on my previous employer’s much more attractive health insurance plan.

Fast forward 8 years, I interviewed for my current job at CU Insurance Solutions; I now have a dependent on my health insurance plan that I cover. Compensation comes up. The salary was important to me; I knew the range. They, fortunately, have employer-paid health insurance (to this day, I am very thankful), but I also wanted to ask about the health insurance rates for covering a dependent. I began my new role with CU Insurance Solutions. After I was hired, our VP of People Strategy, Elizabeth Ingram said one of the things that stuck out to her about me at the interview as I had asked about the insurance plan and rates upfront, and that wasn’t very common.

I discovered in a recent survey from Bank Rate that apparently 55% of people in the workforce are actively looking for a new job! 55% is a large number; with the pandemic, most employees are citing more flexibility, the ability to work from home, and higher salaries. You can look at a job description, and see qualifications, experience needed, the salary range offered, employer-paid insurance for the employee, 401k matches, etc. But for some prospective employees, the health insurance coverage and pricing is one of the most important parts of the compensation package!

Over the years, I’ve unfortunately seen several people take a higher salary only to realize once they sign up for the health insurance, they actually took a pay cut. I’ve had friends and family members go through multiple interviews at companies only to decline the job because they were finally able to see what health insurance was offered.

Why is it not common practice to ask for insurance rates upfront, or have them displayed to prospective applicants? Especially if you are an employer that helps cover the costs of dependents or family plans! Shout it from the rooftop; it’s a big deal!

If you are someone looking for a job, how much more willing would you be to apply for a position that was just as transparent about health insurance plans/pricing/rates as they were about the salary and expectation of the job?

Maine -The Way Life Should Be (and a great consumer information resource too!)

Article By: Bev MacMillan, AAI

Senior Vice President of Insurance & Compliance, CU Insurance Solutions

I’m a real Mainer and proud of it…born here, love the lifestyle and everything that this beautiful state has to offer! I’m thankful every day that I live in a state that is unique in so many ways and shines when it comes to a commitment to consumer protection.

Speaking of which, if you’re not already aware of the Maine.gov website (www.maine.gov) and the consumer information available to you, I’d like to take this opportunity to make sure you know that your state has a wealth of information that can help you, the consumer. Many other states offer similar information on their state websites (i.e. www.nh.gov, www.mass.gov, www.vermont.gov, etc.).

Being a seasoned insurance and compliance professional, I’d like to focus on what resources are available as they relate to the insurance industry but encourage you to explore Maine.gov for other categories of information for which you may be seeking trustworthy guidance.

From the home page of Maine.gov, search “Insurance” in the field located at the middle top of the screen. This will bring you to a myriad of different types of insurance products and consumer guides to help you better understand the policies you purchase: Personal and Business Auto, Flood, Homeowners, Workers Compensation, Health Insurance, Life, Annuities, and Medicare Supplements to name a few. In addition, should the need arise, and you have a complaint involving an insurance matter that you are unable to resolve through your carrier or agent, this site can provide you with guidance on navigating how to proceed.

An educated consumer is a happy consumer! Take advantage of everything our great State of Maine has to offer and be familiar with Maine.gov