The Maine Bureau of Insurance Approves Health Insurance Association for Maine’s Credit Unions

INSURANCE TRUST

2 Ledgeview Drive

Westbrook, ME 04092

MEDIA RELEASE

For Immediate Release

April 19, 2019

The Maine Bureau of Insurance Approves Health Insurance Association for Maine’s Credit Unions

(Westbrook) – On March 29, 2019 the Maine Bureau of Insurance approved a new Multple Employer Welfare Arrangement (MEWA), an association formed to provide a collective non-profit health insurance program, for Maine’s 54 Credit Unions. The MEWA has been named “Maine Credit Union League CU Insurance Solutions” and will be governed by a board of 7 trustees to represent its more than 500 employees. The non-profit health insurance plan will be administered by CU Insurance Solutions in Westbrook, ME, an insurance agency founded in 1963 by Maine Credit Unions. The association is sponsored by the Maine Credit Union League, Maine’s credit union trade organization.

“This employee benefits association for Maine’s Credit Unions is something that’s been needed for a long time. For many years, I’ve known this was a possibility, and CU Insurance Solutions is truly honored to have led the charge in the creation of the Maine Credit Union League CU Insurance Solutions. This would not have been possible without the amazing cooperative spirit of the Maine credit union movement; we are truly better together when it comes to health insurance. I believe it’s vitally important that we take care of our credit union employees and their families, so that the credit unions’ employees can best take care of their members and their communities. We are proud knowing this program will continue to help credit unions and their employees for years to come.” – Kim Daigle President & CEO, CU Insurance Solutions

About CU Insurance Solutions

CU Insurance Solutions was founded in 1963 by Maine Credit Unions to provide insurance solutions for their members. For over 50 years, CU Insurance Solutions has been the premier provider of insurance and loan protection products throughout the Northern New England credit union community. Visit insurancetrustweb.com/cuis for more information.

About Maine Credit Union League

The Maine Credit Union League is a nonprofit, professional trade association that exists to serve Maine’s credit unions. Founded in 1938, the League is committed to helping credit unions succeed, and improve the financial lives of their members.

For more information please contact:

Seth McClellan

Marketing Director

2 Ledgeview Drive, Westbrook, ME 04092

Office: 207-887-8255

smcclellan@insurancetrust.us

Insurance and Financial Checklist for Soon-to-be and New Parents

By Elizabeth Ingram (who just added child #2)

Vice President of People Strategy

Finding out you are having a kid, even if planned, is overwhelming. What do you need to have on hand or want? When do you start to prep & who do you turn to for advice? Your family & friends will probably be able to give you tons of advice on where to register & their favorite diaper brands or tricks (& there’s something to learn every time as I’ve recently discovered thanks to my coworker & mom of 3, Heather Baird, who is also our benefits Account Manager). However, there are also a bunch of long-term items that you need to be on top of to take care of your growing family.

Before Baby Arrives

- Start looking for childcare ASAP if one parent isn’t planning to stay home. A lot of childcare centers have long waiting lists for babies or don’t accept them until 6-12 months. Also, this is going to have a major impact on your budget & the sooner you know how much you’ll be shelling out each week, the sooner you can plan. Ask friends, family, & coworkers with young kids for advice or check out https://www.maine.gov/dhhs/ocfs/ec/occhs/child-care.html in Maine.

- Find a pediatrician around the middle of your pregnancy. Your primary care doctor may also care for kids, but if they don’t, ask for a recommendation. If you don’t have a primary care doctor, or don’t feel comfortable with their advice, crowdsource & then meet the pediatrician to make sure you feel comfortable with them (think of it as an interview). You’ll also want to make sure the doctor is in-network for the medical coverage that will be covering the baby as it will save you some major money on those first-year vaccines.

- Check-in with HR (human resources) if you are working (both parents need to do this) to find out what your Family Medical Leave (HR) eligibility is. On the federal level, FML applies to groups with 50+ employees (https://www.dol.gov/agencies/whd/fmla), and in Maine, a more limited FML applies to groups with 15+ employees (https://www.dol.gov/agencies/whd/fmla). Your eligibility depends on how long you have been with the company and how many hours you work. You will also want to ask whether leave needs to be taken as a block or can be taken intermittently. Also, ask HR if you are eligible for any paid leave and confirm what you have for sick and vacation time.

Pregnant moms will also want to confirm with HR if they have short term disability (STD) coverage. STD can be an employer-paid benefit or a voluntary benefit that you pay premiums for; you might have neither or both. If you have coverage, check what the waiting period after birth (or being taken off work by your doctor) is as well as how long it lasts (generally 6 weeks) and how much of your income it replaces. You won’t be receiving your full paycheck while STD is being paid, so you’ll want to budget for this ahead of time.

Before baby comes is also when you should start looking into life insurance if you don’t already have it & deciding who you want to have guardianship of your children in the case of your death. More on this below.

After Baby Arrives

You’ve just brought baby home and just making sure that little bundle stays alive and sleeping are all you have on your mind, but before you go back to work and things get even busier for a time, there are a few things worth taking care of to secure your little one’s future.

- Add baby to your health insurance within 30 days of his/her birth. Otherwise, you’ll have to wait until your health plan renewal. You’ll need to get a form from HR and while you’re at it, ask how your premium (and paycheck) will be impacted if you haven’t already.

- Create or update your will. I know this is easy to put off, but it’s the ultimate in saying ‘I love you’ to your kids. You can see a lawyer, buy a willmaker program, or use your LegalShield coverage. You and your spouse should have wills that mirror each other when it comes to who gets your assets and, more importantly, who takes care of your kids. You’ll need to pick a guardian for your kids and you’ll want to choose someone who is responsible for handling finances as well. Make sure to sign the finished wills and have at least a couple copies. Each kid requires an updated will that includes their information.

- Life insurance. If you already have this, now is the time to revisit whether you need more or just need to update the beneficiaries. Remember that minors shouldn’t be direct beneficiaries so you can use the Uniform Transfers to Minors Act or another option that better fits your needs instead.

- If you don’t already have life insurance and you aren’t crazy rich, please consider this. I know money is getting tighter, but the premium cost is worth it. You should at least have enough to pay off any debts (student loans, mortgage, care loans, credit card debt, etc.) and for a funeral (which can run to $10,000). However, if you can afford it, you should try for enough coverage to cover your children’s expenses to age 18 or through college. You may be able to get a voluntary, transferable policy through work (such as through Colonial), or you can meet with a financial advisor to see what you can afford.

- Speaking of a financial advisor, you’ll want to update the beneficiaries on any retirement accounts you might have both in & out of the workplace. You’ll need to do this each time you have a kid. Don’t forget to update your HSA beneficiaries as well if you have one.

- If your kid was born in Maine, they are eligible for a $500 contribution to their 529 college fund in the first year of life through the Alfond Fund (https://www.500forbaby.org/). You do need to set up the 529 which you can do on your own or with your financial advisor. It doesn’t cost you anything to set up (other than your time), and it ensures that your kid has something saved for college. Even better, the Alfond fund matches contributions at 50% to $300 (i.e. you put in $600 & they put in $300) in the first few years of life, so when your playroom is overflowing with toys and relatives want to give your kids presents, you can direct them towards the college fund. That’s right; anyone can contribute to the 529 once it is in place.

- Once you get a copy of your kiddo’s birth certificate, it’s time to freeze their credit. Our December blog post (https://insurancetrust.us/how-to-freeze-your-childs-credit-for-fraud-prevention/) details how.

- Another kid, another tax deduction. Take a few minutes and make sure that your tax deductions are set up correctly (https://www.irs.gov/individuals/irs-withholding-calculator), so you have money to pay bills now and no nasty surprises come next tax season. You will need total household income and pre-tax deductions to do this, but it’s worth the time. Keep in mind that this is a changing target, so check back at the beginning of each year. You’ll need to provide your updated W4 forms to HR or payroll to make changes.

- I’m sure you’re feeling as though you’ve done more than enough at this point (I know I did), but there’s one more thing to do. If you can afford it, now is the time to get a whole life insurance policy on your newest addition. Whether it’s through your voluntary coverage at work (such as Colonial) or the Gerber policy that you’ll probably receive a mail offer for soon if you haven’t already, now is the time. For the cost of a cup of coffee or two, you can get whole life insurance on your baby that will protect them and you for a lifetime. For now, it will pay in the event that every parent’s worst nightmare comes true and you have to bury your baby. Otherwise, it’s a security that if your child becomes uninsurable, they have some coverage as an adult.

- Effective 1/1/2020: The NextStep Matching Grant changes from 50% of contributions over $50 for the year to 30% of contributions over $50 for the year; the grant cap remains at $300/year. More information can be found at https://www.nextgenforme.com/matching-grants-for-maine-residents-changing-january-1-2020-for-calendar-year-2020/. If you aren’t a Maine resident (or need another account to be in your name for employer gifting/matching), you can easily set up a 529 at https://collegebacker.com/. It took me about 15 minutes and lets you put in as little as $5.00 at a time.

And remember, that you aren’t alone in this. If you aren’t sure what needs to be done or how to do something, reach out to HR, your benefits broker, or a financial advisor. Your family deserves the best.

CU Insurance Solutions 56th Annual Meeting & Silent Auction for Special Olympics Maine

CU Insurance Solutions is pleased to announce its 56th annual meeting that will take place at 2:00 pm on Friday, April 26, 2019, at the Italian Heritage Center in Portland, ME. Join us as we celebrate more than half a century of service to the Maine credit union community.

During our meeting, each Trust committee chair will report on their committee’s accomplishments during the previous year. You will also be brought up-to-date on the financial condition of CU Insurance Solutions. There will be 1 Trustee-at-large position open and will be voted on at the annual meeting. There are also 3 Credit Union Chapter Trustee’s up for election. Trustee terms are for three years and we are currently accepting nominations for Trustee-at-large.

As part of our meeting each year, the CU Insurance Solutions Social Responsibility Committee will be recognizing our credit union partners for their generous efforts and contributions to Special Olympics Maine. We will also present the annual Sandra A. Doucette award to an individual for outstanding service, volunteerism and support of Special Olympics Maine. Join us for a reception directly following our meeting with complimentary fare and refreshments.

Silent Auction for Special Olympics Maine

This year, CU Insurance Solutions will be holding our Third Annual Silent Auction with all proceeds to support Special Olympics Maine. If your credit union would like to donate an item for the auction, please let us know!

Contact Us for More Info

To register as a delegate/alternate or guest at the CU Insurance Solutions 56th Annual Meeting, please contact Barbara Christy at bchristy@insurancetrust.us or complete the contact form below.

Newsletter Signup

2019 Management and Lending Roundtable – Register Now

Set the Course for Success at your Credit Union

with Chris Maynard and Mike Higgins May 6-8, 2019

Hollywood Hotel & Casino | Bangor, ME

VIEW REGISTRATION INFORMATION

Chris Maynard will explore the following management focused topics, and more:

- How to build and retain high-performance teams

- How to drive results throughout the organization

- How to turn your Call Center into a Loan Center

- How to grow ancillary product sales and non-interest income

Mike Higgins will provide real-world examples of how credit unions successfully manage and compensate for performance. We will review the process for developing a reward pool that benefits the credit union, its members and its employees. The session will explore how organization-wide objectives can be broken down into department and individual scorecards.Day 3 Lending Roundtable (Designed for Officers, MSRs)

Chris Maynard will explore the following lending focused topics and more:

- Referrals and Sales through Advocacy.

- Key strategies to improve your member’s credit score and close more loans

- The 4 C’s of Lending. It’s so much more than Credit Score and DTI

- How to take a conversational loan application using PPC’s 4 Step Loan Detector

Cautionary Auto Lending Trends for 2019 – Part 2

Pictured Above: General Motors Co.’s Detroit-Hamtramck Assembly Plant in Detroit, Michigan. Photographer: Jeff Kowalski/Bloomberg

By Tim Dalton | EVP CU Insurance Solutions

In my last article, I had expressed a few predictions about the future of auto lending and the impacts they may have in the near future. Sadly, we are seeing auto manufacturers start to react to the changing marketplace at least domestically. I believe there is still an underlying fear of what happened during the bailout era for the auto manufacturers.

Late in November of 2018 GM announced it will close 7 factories, cutting 14,000 jobs by the end of next year. This will boost GM’s cash flow by 6 billion dollars by 2020. The reasoning behind this, so told by GM, is the realignment to prepare for electric and self-driving cars. Yet after digging deeper into the major changes, some of the real facts emerge. GM stated that “four factories in the US could be shuttered by the end of 2019 if the automaker and the unions don’t come up with an agreement to allocate more work to those facilities.” At the same time, GM is looking to abandon some of its slower selling sedan models. These lines include The Buick Lacrosse, the Chevy Impala, Cadillac CT6, and the Chevy Volt (fully electric car) and Cruze. The Cruze will continue to be made in Mexico but only for other markets outside the US.

Not to degrade these models that are being dropped, but they are of lower cost than crossover models and they are not selling. Why? The leasing markets. More consumers were leasing in 2015, 2016 and even 2017 and that will start to pour more preowned autos on to the market, hence driving down wholesale prices and lowering values across the board. Still, why were consumers not buying these autos? It comes down to value and what you want for your dollar. You can buy a Chevy Impala for $360 a month or lease a Yukon for $360 a month. You decide.

GM stated that “Most of the one-shift plants are sedan plants” and “That’s a real mismatch in a market where 40 percent of the vehicles sold are crossover utilities.” GM’s thought behind this is to “take action” while the economy is strong. However, the comment stated by GM at this year’s Automotive Outlook Symposium (AOS) was “To stave off the fire sales of the past;” is this statement truer to the positioning of their business model?

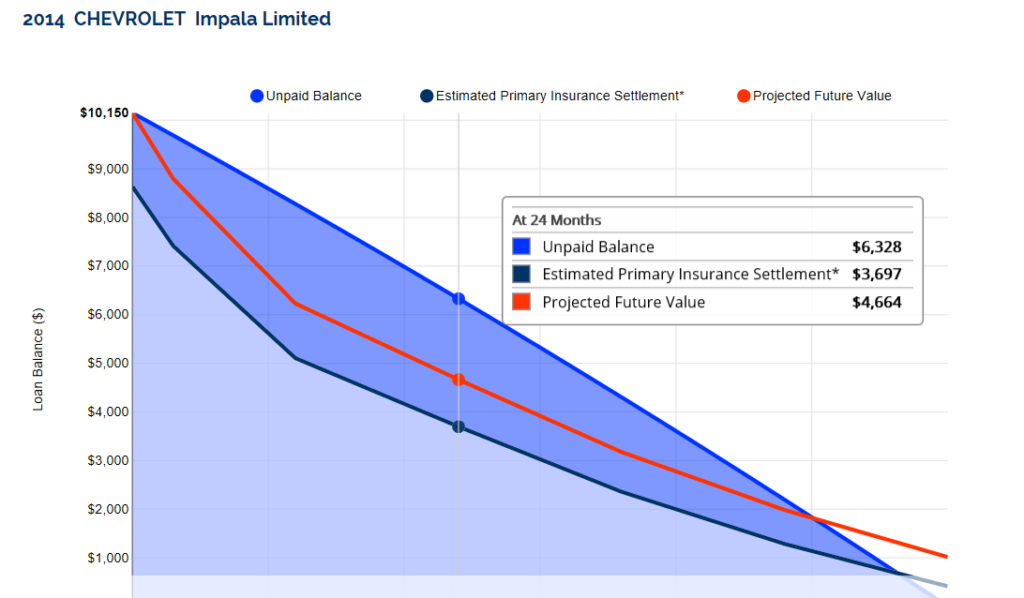

This comes down to a few variables to be aware of and how we continue to lend in the auto market for the future. My first thought is: how will this affect the Loan to Value (LTV) on loans that are currently on the books at our Credit Unions? With the loss of these product lines, how will it affect their values? In the past, when product lines were dropped, values have pitched more heavily downward in value then standard depreciation predicts. Even in a strong marketplace, we see loan values higher than values of the collateral for 70% to 80% of the loan cycle. In your typical 60-month term loan, most vehicles do not turn right side up in value until year 4, and that is if the vehicle is maintained well and kept within the 15,000 miles per year range. My second concern is: how do we lend to members with significant loan deficits at trade, who are left with no other option because of a total loss or severe mechanical issue?

2014 CHEVROLET Impala Limited Based on dealer retail value $10150.00 NADA at 24 months

Disclaimer: Projected Future Values are provided by Automotive Lease Guide. The Estimated Primary Insurance Settlement reflects estimated primary insurance settlement values after a total loss once the deductible has been applied and after adjustments for local market comparisons, actual vehicle condition, mileage and vehicle options. All values represent future projections and are not purported, warranted, or to be construed as absolutes.

I am not predicting that members/consumers will stop paying their loans. However, my concern is with a 22 month turn time where consumers are trading their cars in and high LTV’s are common, what are we going to do to protect both our members and our Credit Unions as our loan values start to change pace in this new auto market? First off, there will be a consumer reaction. Consumers will not be able to get the value they need to purchase and pay off their existing loan balance. Or their payment will be too high to afford, especially in a higher interest rate market place. Credit Unions will want to see more money down to control LTV in a declining value market, steering more members to just keep their current vehicles longer. In turn, this will slow auto sales, slowing auto lending and changing our short-term higher interest note income. We need to be thinking about how to protect the current outstanding loans since the future is looking to a change in loan volumes and loan values.

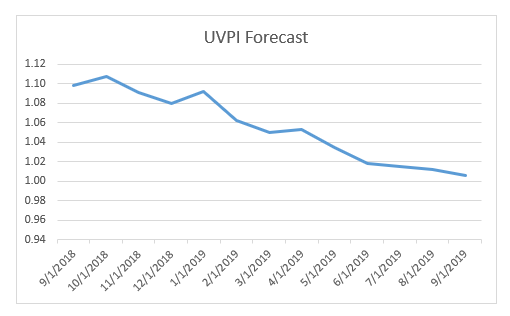

RVI Analytics UVPI (Used Vehicle Price Index)

But how do we protect those members that do not have the option of just keeping their vehicle longer because of a totaling event or severe mechanical breakdown? The answer is simple, by adding Guaranteed Asset Protection (GAP) to loans to stave off potential loan deficits for our members and adding Vehicle Service Contracts (VSC) help or solve future mechanical breakdowns problems. In this changing market, the relevance of these types of programs is more necessary than ever to protect our Credit Unions’ members.

How do we protect our Credit Union? Through the protection of programs such as LSI (Lenders Single Interest) or CPI (Collateral Protection Insurance). Both programs have benefits for protecting the Credit Union’s assets. LSI is a fee that is charged during the inception of an auto loan. This protects the Credit Union in cases of damage or a total loss even if the Credit Union is in a situation where repossession is occurring. There is no tracking for Credit Union staff since it is charged on every loan. CPI is a no charge scenario, but this demands the member carry insurance for the term of the loan at the same time the Credit Union is charged with tracking insurance information. If the member lapses on their insurance premium forced-place insurance is placed on to the loan modifying the member’s monthly payment. This insurance does not protect the member and does not constitute insurance coverage should the member be involved in an accident. It only protects the Credit Union asset during a repossession event.

Lastly, how can staff help to protect the Credit Union? Training on GAP, VSC and Debit protection more relevant; teaching staff the relevance and value of these programs and the “Why” behind them. These programs offer higher value to your members at a lower cost than the retail business in the marketplace. The better your staff understands the “Why” behind your Credit Union, the more successful the Credit Union will be and the happier your members will be.

Continue to be the best option in your marketplace by offering to help your members to be more financially viable. If your members are financially healthy then so is your Credit Union.

Newsletter Signup

The Difference Between Workers’ Comp Vs. Disability Coverage

By Elizabeth Ingram | Vice President – Operations CU Insurance Solutions

Knowing when workers’ compensation applies rather than disability insurance coverage can be confusing. Here are a couple of pointers to help distinguish between the two different types of coverage:

Workers’ Compensation

Workers’ compensation (once known as workman’s compensation) is for job-related injuries and illness. If an employee gets injured in the scope of their job and loses time or requires a medical visit, you should report the injury to your workers’ comp carrier. If you work with Equinox and aren’t sure what to do, reach out to Bev for help. Remember that injuries that occur in the parking lot or off of your premises may also be workers’ comp and it’s better to report than not. Your workers’ compensation carrier will determine if the claim meets the definition of workers’ comp and work with you and your employee to pay out the claim. Workers’ compensation coverage provides coverage for medical costs (which may not be covered by your employee’s medical insurance) and for time lost. They also help get employees back to work. You may be required to have workers’ compensation coverage in the state of Maine.

Disability Insurance

Disability insurance is for non-work-related injuries or illness. It is a method of income replacement when an employee out of work for an extended period of time. You are not required to provide your employees with disability coverage, but it’s a great way to show that you care and get them back to work. It does not provide full income replacement.

- Short-term disability (STD) coverage begins after 1-30 days and generally runs until the employee is medically able to return to work or until 90 days.

- Long-term disability (LTD) generally begins after 60 or 90 days and generally runs until the employee is medically able to return to work.

- You can offer employer paid STD, LTD, both, or neither. You also have the option to offer voluntary disability coverage which is employee paid.

Like the workers’ compensation carriers, disability carriers will work with you and your employees to get them back to work.

Remember too that workers’ compensation and disability coverage may run concurrently with job protections such as Family Medical Leave (on the state (15+ employees) or national (50+ employees) level) and the Americans with Disabilities Act (ADA) (employers with 15+ employees).

Please reach out to our benefits (hbaird@insurancetrust.us or kquint@insurancetrust.us) or commercial lines (bmacmillan@insurancetrust.us) divisions with any questions.

How to Freeze Your Child’s Credit for Fraud Prevention

By Elizabeth Ingram | Vice President – Operations CU Insurance Solutions

Federal law now allows adults to freeze their credit for free and allows parents to freeze the credit of their children who are under age 16 for free as well. Being able to freeze a child’s credit is a new measure that is helping to make it harder for identity thieves to steal your child’s credit under the radar and helps your child maintain an empty credit history until they’re ready to start out in the world. The Maine Credit Union League posted an article detailing more about this change here.

To Get Started

Go to https://www.identitytheft.gov/creditbureaucontacts. You’ll need to contact each of the credit bureaus separately either online or by phone as an adult. For a child, the credit bureaus require you to mail them your request. Be prepared to put a little time into this and remember that the freeze won’t be instantaneous. Specific directions and links to forms are below, but we recommend that you gather your child’s social security card, birth certificate, your proof of identity, a copy of a bill (as detailed below for Experian), and proof that you are an authorized representative of your child before you get started.

Equifax

(https://www.equifax.com/personal/credit-report-services/): to freeze a child’s credit, you need to complete a paper form along with copies of your child’s social security card and birth certificate as well as proof of your identity (government ID, SS card, or birth certificate) and proof that you are the parent or authorized representative (minor’s birth certificate, court order, executed & valid power of attorney, or foster care certification).

Experian

(https://www.experian.com/freeze/form-minor-freeze.html): to freeze a child’s credit, you need to mail them a paper form with your child’s full name, SS number, date of birth, current mailing address and previous addresses for the past 2 years, your full name, SS number, date of birth, and current mailing address and previous addresses for the past 2 years. You will also need to include copies of your child’s social security card and birth certificate as well as proof of your identity (government ID, SS card, or birth certificate), a copy of a utility bill, bank, or insurance statement that includes your name, current mailing address, and a recent date of issue. If you are the child’s guardian, you need to supply a copy of the court document naming you as guardian as well.

Transunion

(https://www.transunion.com/credit-freeze): to freeze a child’s credit, you need to mail them a written request to freeze the child’s credit; I recommend that you include the information requested by Equifax and Experian on their forms. You will also need to send copies of your child’s social security card and birth certificate as well as proof of your identity (government ID, SS card, or birth certificate) and proof that you are the parent or authorized representative (minor’s birth certificate, court order, executed & valid power of attorney, or foster care certification).

Remember, do not send any original documents to the credit bureaus as they are unable to return materials.

Cautionary Credit Union Auto Lending Trends for 2019

Article by: Tim Dalton EVP CU Insurance Solutions | CUAlliance

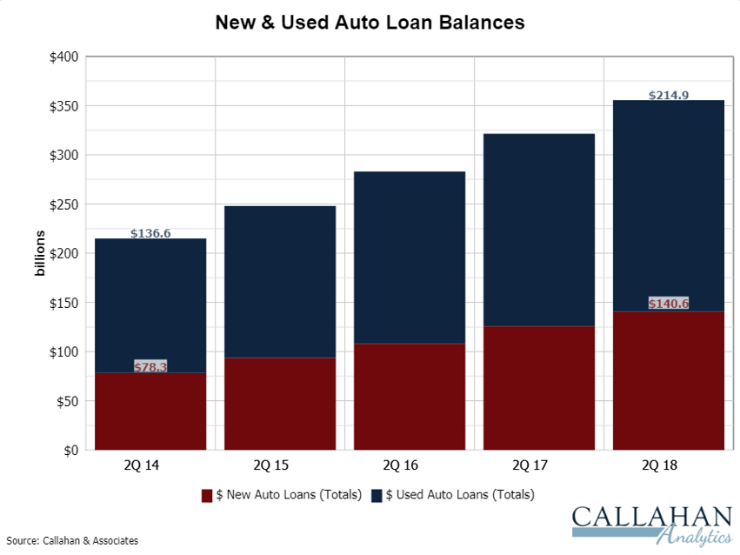

Over the last several years, credit unions have invested an increasing percentage of their loan portfolio in the auto lending market. In fact, within the past four years, credit union new and used auto loan balances have increased 64% nationally.

At the same time, credit unions have been increasing activity with indirect lending programs. Indirect loans now make up 59.6% of the auto lending marketplace nationwide. With 35% of our credit unions holding indirect loans nationally.

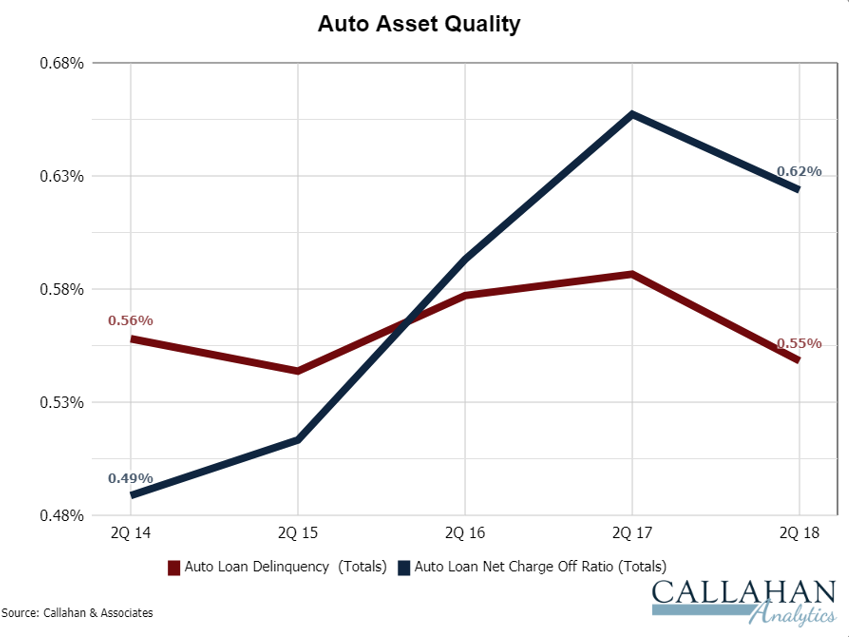

This “Auto Asset Quality” chart below from Callahan Analytics shows credit unions are seeing favorable decreases in delinquency rates by 4 basis points and a decrease in charge-offs by 4 basis points since 2017. These changes can be attributed to several variables. Stronger lending guidelines, loan protection services and better collections process.

This brings us to 2019. According to the consensus forecast from the 2018 Automotive Outlook Symposium (AOS), the growth rate of the U.S. economy is predicted to be above its long-term average in both 2018 and 2019 (though growth next year is anticipated to be moderate). Light vehicle sales are forecasted to decrease from 17.2 million units in 2017 to 17.0 million units in 2018 and decrease to 16.7 million units in 2019.

Not only are light vehicle sales are forecasted to decrease in 2019, but auto industry projections also show all of the major manufacturers are preparing for a change in 2019.

Tom Kontos noted at AOS this year that auction volumes are likely to continue increasing over the coming years chiefly because new vehicle sales reached substantial levels in 2015–17 and these will shortly generate a greater supply of used vehicles. He said he expects the wholesale used vehicle supply to grow 5% on a year-over-year basis in 2018, inducing a 2% to 3% decline in wholesale prices this year. The increasing supply will soften wholesale prices for vehicles.

Analysts at Morgan Stanley are already stating that Automotive sales are “clearly on the downslope post peak,” and “We’ll need more incentives and higher fleet mix just to stand still.” Hoping to create market stabilization with inventory controls.

General Motors has already started to gear down to stave off the impending “fire sales of the past”.

Effect on Credit Union Lending

This type of change in market conditions could have a twofold effect on current outstanding loans in your portfolio:

- A potential devaluation of your current collateral – With a 5% increase in the supply of used vehicles and an expected decline in wholesale vehicle prices, the value of vehicles will likely decrease.

- Member demand or willingness to purchase new vehicles – With less attractive new vehicle sale prices, members will likely keep their vehicles longer or choose to buy used over new in some cases.

Not to be doom and gloom in regards to future auto lending but the proposed question to the CU Insurance Solutions is how do we help protect our clients’ income and assets in what appears to be a declining sector over the coming year. CU Insurance Solutions is dedicated to continually reviewing the conditions of the marketplace and providing tools to help credit unions navigate new challenges in that marketplace as they arise.

It should be noted that Maine has always been a microcosm of difference from the national marketplace. I am not saying we are unaffected by the national mainstream we just lag behind it.

References:

- Callahan Analytics

- 2018 Automotive Outlook Symposium

- Morgan Stanley

- General Motors Corporation

Newsletter Signup

Providing the Required Employee Benefits Notices to Employees

Open enrollment season is upon us. Employers are required to provide employees with certain benefit notices during this time of year. It is important to know which notices your group is required to provide.

For example, the summary of benefits and coverage (SBC) must be provided at open enrollment time. Other notices must be distributed annually, such as the Women’s Health and Cancer Rights Act (WHCRA) notice and the Children’s Health Insurance Program (CHIP) notice. CU Insurance Solutions includes these notices in employee packets to help our clients satisfy this requirement.

However, there are some notices that will vary by group. For example, Employers with Medicare Part D eligible individuals must notify them about whether the drug coverage is creditable or non-creditable before October 15 each year. Employers may not easily be able to identify those who are eligible for Medicare Part D, so many employers choose to satisfy this requirement by providing the notice to all plan participants.

Groups that are subject to ERISA must provide new health participants with a Summary Plan Description (SPD) for each benefit offered within 90 days of when coverage begins. In lieu of a SPD, a “wrap” document can satisfy this SPD requirement in one document for all plans offered. The(se) documents needs to be maintained annually and if any material modifications have been made, updated notices must be provided to participants at least every 5 years. (If no material modifications have been made, every 10 years.)

Groups’ health plans that are subject to COBRA must provide a written General Notice of COBRA rights to covered employees within 90 days after their health plan coverage begins. This is often added to open enrollment materials as it will satisfy the requirement for new enrollees added at open enrollment. It is advisable to include this in any new hire packets as well.

The Notice of Patient Protections is required when plan participants are required to designate an in-network primary care provider. This is often included in the insurance certificate provided by the issuer or Summary Plan Description.

CU Insurance Solutions works closely with clients to assist in complying with State and Federal laws. If you have questions about your responsibilities as an employer or would like assistance, feel free to contact us. Thank you and here’s to a successful season!

Newsletter Signup

Call Center Services for Helping Your Credit Union to be #AlwaysLIVE

CU Insurance Solutions is partnered with Lending Solutions Incorporated (LSI), an innovative company helping credit unions grow their loan volume while serving their members more efficiently. LSI provides customized “#AlwaysLIVE” programs that act as an extension of your credit union by serving your members beyond traditional business hours to stay competitive in today’s demanding service environment.

With consumer debt set to reach $4 trillion by the end of the year, members today are more stressed about their personal finances than ever. When people are stressed, they want to connect with someone LIVE to ask questions, reduce their fear and celebrate their Key Life Moments. Even today’s “Digital Native” segment of members wants to connect with someone LIVE to talk about rates and programs when filling out a loan application.

Being #AlwaysLIVE with LSI can enable credit unions to engage, connect and convert more of your in-market members, as well as provide Remarkable Service for account inquiries, outbound campaigns and collections. In today’s time-starved world, LSI’s solutions enable you to connect your members with a warm and friendly voice any time of day and anywhere your members may be.

Consumer Lending

- #AlwaysLIVE loan processing and underwriting

- Decisions provided while the member is on the phone

- LSI interfaces with many leading data processors

- Cross-selling

Debt Management

- #AlwaysLIVE outbound calling

- Payment Reminder proactive for under 30 days

- Debt Collection for between 30 and 120 days

- Updates provided to client’s database

Mortgage Lending

- #AlwaysLIVE service

- Member access by phone or internet

- Member needs analysis consultation

- Third party platform support

- Variable service level options

Member Service

- #AlwaysLIVE and WebChat service

- New member application processing

- Core connections with API

- Disaster recovery and business continuity

- Cross-selling of lending and deposit products

Digital Lending

- #AlwaysLIVE service

- Proprietary WebReach service

- Automated decisions

- Underwriting on non-automated decisions

- Mobile application

- Network of data-processing interfaces

Outbound Campaigns

- #AlwaysLIVE service

- Micro loan

- New member welcome

- Back-to-School

- Credit card

- Holiday loans

- Credit card activation

- Mortgage loan

- Auto loan

- Member referral

- Member surveys

- Refinance

Indirect Underwriting

- #AlwaysLIVE service

- Third party indirect lending platforms

- Decisions based upon client guidelines

- Competitive response times for dealers

For more information, contact CU Insurance Solutions Executive VP, Tim Dalton, at tdalton@insurancetrust.us or complete the contact form below.