Frost Participates in Important GAP Amendment to Maine LD 1506, a Win for State Chartered Credit Unions

As you may know, the recent Maine LD 1506 bill regarding the governance of GAP waivers has passed. The bill was signed by the governor (Public Law Chapter 178) on June 12, 2017 and the new law will apply to all GAP waivers that become effective on or after January 1, 2018.

Our partners at Frost Financial Services are long-time members of GAPA (Guaranteed Asset Protection Alliance). GAPA is an alliance of companies whose mission is to preserve the viability of the GAP industry, promote fair and equitable regulation of its members and their products and to continue to offer meaningful options to consumers who choose to purchase this protection.

Part of GAPA’s legislative initiative in Maine was to amend the Maine LD 1506 bill to protect financial institutions from requiring that GAP waiver contracts be cancelable with a pro rata refund. The initiative was successful and Maine state-chartered credit unions remain exempt and safe from this new requirement.

Why is this important?

This exemption essentially protects the viability and competitive market price for GAP waivers sold within the credit union channel. If state chartered credit unions were required to sell a refundable GAP product, pricing would need to increase dramatically to offset the refundability requirement. This could not only make the product harder to offer but, as a result, lead to increased delinquency exposure and reduced non-interest income for Maine credit unions.

Despite the exemption for state chartered institutions, passage of the GAPA Model Act does help clarify some important requirements that will ensure the long term viability of the GAP program. The key components of the GAPA Model Act include:

- Codifies that GAP waiver is not insurance;

- Codifies required disclosures;

- Provides that retail sellers are required to be backed by a Contractual Liability Insurance Policy (CLIP);

- Specifies requirements for a CLIP; and

- Specifies mandatory terms of a GAP waiver.

Click here to download a copy of the Maine LD 1506 Legislation

Contact Us

The Importance of the Used Vehicle Buyer’s Guide for Credit Unions

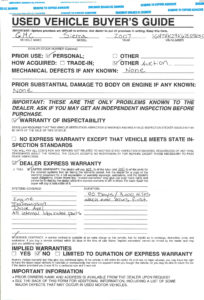

When a member is financing a used vehicle with your credit union, it is critical to ask them to see the Used Vehicle Buyer’s Guide during the loan application process.

The Used Vehicle Buyer’s Guide contains many important factors that can affect the vehicle’s value. Maine law requires dealerships to display this document in the window of all used vehicles for consumer disclosure. However, the law DOES NOT require dealers to disclose this guide to the credit union (i.e. lienholder) so this important information can be easily overlooked regarding a loan decision.

What info can be found on the Used Vehicle Buyer’s Guide?

- Year, make and model

- Prior use (personal transportation, rental vehicle, municipal, etc.)

- How the vehicle was obtained

- Major mechanical problems (motor, transmission, etc.) even after repair

- Prior damage (resulting from fire, flood or collision) exceeding $2,000 in repair

- Warranties offered by the dealer (indicating either: Dealer Express Warranty, AS IS or Maine State Inspection Only also referred to as Warranty of Inspectiblity)

Why is it important to consider this information?

The most important reason to consider the Used Vehicle Buyer’s Guide information is loan-to-value (LTV). Every credit union has differing loan policies that state how much they are allowed to lend with regard to LTV. Most credit unions use the NADA Used Vehicle Guide to determine a vehicle’s clean retail value. The definition of clean retail is: No mechanical defects and passes all necessary inspections with ease; paint, body and wheels may have minor surface scratching with a high gloss finish; interior reflects minimal soiling and wear, with all equipment in complete working order; vehicle has a clean title history; vehicle will need minimal reconditioning to be made ready for resale. However, a vehicle that is listed as “Maine State Inspection (MSI) only” or “AS IS”, is NOT a retail unit and can be worth far less than the value stated by an NADA valuation. In most cases these vehicles do not qualify for a vehicle service contract, but if they do, most or all of the claims submitted will be denied for preexisting conditions.

What does Maine State Inspection (i.e. Warranty of Inspectability) mean?

What does Maine State Inspection (i.e. Warranty of Inspectability) mean?

Used cars that are sold by a dealer as retail must have an inspection sticker issued within the past 60 days. This is called a ‘Warranty of Inspectability’. This indicates that the vehicle has been inspected for the purposes of issuing an inspection sticker, and will pass inspection on the date of purchase. However, vehicles designated as ‘MSI Only’ have passed on ONLY inspectable safety items. Mechanical components such as the engine and transmission have not been inspected or verified by the dealer.

When may a used car be sold without a Warranty of Inspectability?

If a vehicle does not have a valid inspection sticker, it will have a posted ‘Unsafe Motor Vehicle’ certificate. This certificate is completed by a licensed inspection mechanic and indicates the car was inspected, but did not pass. The certificate will list the items that failed inspection. If a member is financing a car with this designation, the vehicle must be towed from the dealer’s lot, cannot be test driven on Maine roadways, and cannot be issued a temporary plate.

The Used Vehicle Buyer’s Guide says that the vehicle is “repaired” “salvage” “rebuilt salvage” or “rebuilt”, what does this mean?

These brands indicate that the vehicle has been declared a total loss by an insurance company, and has been repaired. This may affect the value of the vehicle and some insurance companies may either not approve or provide a reasonably affordable insurance policy option on vehicles with these branded titles.

Is the dealer required to give a 30-day warranty on used vehicles?

No. Maine law does not establish a set warranty coverage (other than state safety inspection warranty). Maine law also does not specify what components and terms a warranty will cover. In many cases, a dealer will have standard written warranty coverage. Review any written warranty carefully to determine the length of the dealer’s warranty and the items covered for your used car. These will be listed on the ‘Express Warranty’ section of the Used Vehicle Buyer’s Guide.

If a member has a question or concerns regarding information contained on a Used Vehicle Buyers Guide, they can contact the Maine Bureau of Motor Vehicles Office of Investigation on the State of Maine website.

Contact Us

15th Annual Special Olympics Maine Golf Tournament

CU Insurance Solutions along with our subsidiary Equinox Financial & Insurance Services will be holding our 15th Annual Golf Tournament on Thursday July 20, 2017.

This tournament is our largest yearly fundraiser for Special Olympics Maine and will take place at Spring Meadows Golf Club in Gray, Maine. Tee off will be at 9:00 am with a “Shot Gun” start. Registration is from 7:45 am to 8:45 am with a continental breakfast available, sponsored by Equinox Insurance. We will also be providing a bag lunch for each golfer and a post-golf reception. Please come out, have some fun and help support Maine Special Olympic Athletes and their families!

Registration fee includes:

- Green fees

- Golf cart

- Continental breakfast

- Bag lunch

- Post golf reception (cash bar available)

- Mulligan (Maximum 4 per team)

Click the link below to download the registration/sponsorship form to register today!

Thank you for supporting Special Olympics Maine!

Fall Lending School with Julie Ferguson – Save the Date

CU Insurance Solutions is gearing up for their semi-annual Lending School event to take place on September 12-13, 2017 at the America’s Credit Union Museum in Manchester, NH. This credit union focused two-day event will be presented by guest speaker Julie Ferguson.

The lending school is split into two 1-day sessions. Day 1 is designed for CEOs and executive management and will explore sales culture, creative growth strategies and business development topics. Day 2 is designed for employees who interact with members on a regular basis. Topics will cover what it means to live the brand, be passionate about making a difference, defining needs, and providing solutions that help members achieve their financial goals and dreams. This will be a highly-interactive workshop. Attendees will have fun, learn, and leave with a renewed passion to make an impact.

About Julie Ferguson

Julie spent sixteen years at First Tech Federal Credit Union in the Pacific Northwest before starting her credit union focused consultancy (JRF Consulting Services) in 2009. Her financial services career began as a part-time Teller and took her on a journey that included stops as a Loan Officer, Branch Manager, Director of Operations, and Business Development Director. While at First Tech, she developed strong relationships with SEGs like Microsoft, Amazon.com and Google. When First Tech became Microsoft’s credit union, her CU grew the relationship from 0 to 15,000 members in 7 quick years. They were problem solvers for their SEGs and the community, and focused on building trust and creating opportunities to educate employers and their employees on a regular basis.

“I’m very passionate about helping credit unions around the country create and execute focused and results oriented business development strategies. I enjoy the challenge of providing new sales and service tools to front line staff and management to enhance existing member relationships.” – Julie Ferguson

America’s Credit Union Museum

Located in Manchester, New Hampshire on the site where America’s first credit union opened its doors in 1908, America’s Credit Union Museum is an exciting and dynamic organization that is no mere repository of documents and artifacts. In addition to celebrating the remarkable efforts of the people who built the credit union movement over the past 100 years, it plays a leading role in documenting today’s achievements while helping to prepare credit unions for upcoming challenges.

Full details and registration info to follow!

CU Insurance Solutions Board Announces the Hiring of a New President/CEO

INSURANCE TRUST

2 Ledgeview Drive

Westbrook, ME 04092

MEDIA RELEASE

For Immediate Release

May 9, 2017

(Westbrook) – The CU Insurance Solutions Board has selected Kim Daigle Blier to lead as its new President/CEO.

Last year, current President/CEO David Baird announced his plans to retire on December 31, 2017, following 11 years of service with CU Insurance Solutions and its subsidiaries, Equinox and CUAlliance.

Originally from Fort Kent, Maine, Kim moved to Florida where she graduated from University of South Florida in 1992 with a degree in Elementary Education. She taught a “Drug & Gang Prevention” program in Tampa’s inner-city schools for three years. Her desire to come back to Maine became reality when she was hired as a General Manager for a small retail business growing from 1 location to 13 locations in 6 years and learning all aspects of managing and growing a business.

Kim also worked as an Account Executive at Anthem Blue Cross and Blue Shield in Maine working with multiple associations plans, employers, employees and brokers. Kim’s decision to start her own business in 2009 was driven by her passion to provide employees and employers with a great benefit selection and education that helps consumers make informed decisions. Eight years ago, Kim formed a new business called Better Benefits, LLC. Better Benefits, LLC is currently assisting over four hundred business clients to help provide benefit education and great benefit selections to employers and employees throughout Maine and New England.

Kim has worked with CU Insurance Solutions and its credit union partners in various capacities for the past 17 years. In the last 3 years, Kim has specifically worked as a strategic partner with the credit unions to assist with their employee benefits education.

“Our Board is delighted with the selection of Kim Blier as CU Insurance Solutions’s next President/CEO,” stated Board Chairman and Five County CU Vice President Mike Foley. “Kim’s strong background in the insurance and benefits arena, coupled with her already extensive familiarity with Maine’s credit unions as a trusted benefits provider and educator, will enable Kim and the Trust team to seamlessly continue their tradition of excellent service to Maine’s credit unions. The Board looks forward to a bright future for the Trust, and the credit unions it serves, under Kim’s leadership.”

“I am incredibly honored to have been selected as the new President/CEO of CU Insurance Solutions,” said Blier. “Over the past 17 years, I have been fortunate to work with credit unions and I have been forever inspired by the integrity and passion that credit unions and their employees have for helping members and the local communities. I am excited to work with the amazing team at CU Insurance Solutions and for the opportunity to help continue and build upon our important work and mission.”

The selection of Kim Daigle Blier followed an extensive search conducted by Drake Inglesi Milardo, Inc. – Human Resource Consultants of Portland and ultimately, the CU Insurance Solutions Board of Trustees. Kim will assume her new position effective August 1, 2017.

About CU Insurance Solutions

CU Insurance Solutions was founded in 1963 by Maine Credit Unions to provide insurance solutions for their members. For over 50 years, CU Insurance Solutions has been the premier provider of insurance and loan protection products throughout the Northern New England credit union community. Visit insurancetrustweb.com/cuis for more information.

CU Insurance Solutions 54th Annual Meeting & Silent Auction for Special Olympics Maine

CU Insurance Solutions is delighted to announce its 54th annual meeting that will take place at 2:00 pm on Friday, April 28, 2017 at the DoubleTree Hotel in South Portland, ME. Join us as we celebrate more than half a century of service to the Maine credit union community.

During our meeting, each Trust committee chair will report on their committee’s accomplishments during the previous year. You will also be brought up-to-date on the financial condition of CU Insurance Solutions. There will be (1) Trustee-at-large elected for a three-year term and we are currently accepting nominations.

As part of our meeting each year, the CU Insurance Solutions Social Responsibility Committee will be recognizing our credit union partners for their generous efforts and contributions to Special Olympics Maine. We will also present the annual Sandra A. Doucette award to an individual for outstanding service, volunteerism and support of Special Olympics Maine. Join us for a reception directly following our meeting with complimentary fare and refreshments.

Silent Auction for Special Olympics Maine

This year, CU Insurance Solutions will be holding a special Silent Auction with all proceeds to support Special Olympics Maine. If your credit union would like to donate an item for the auction, please let us know!

Contact Us for More Info

To register as a delegate/alternate or guest at the CU Insurance Solutions 54th Annual Meeting, please contact Barbara Christy at bchristy@insurancetrust.us or complete the contact form below.

Newsletter Signup

Turn a Total Loss into a Fresh Start for Your Credit Union Members

One of the biggest financial risks that both members and credit unions face is the fact that vehicles experience significant depreciation the minute they are driven off the lot. We know that GAP Waivers offer members protection against some of the risk of depreciation by helping to waive any remaining loan balance after the primary insurance settlement in the event of a total loss. However, GAP Waivers do not always help the borrower get back into a vehicle comparable to the one they originally purchased. A few reasons for this are diminished market value, inflation and that primary insurance carrier settlements are often under book value. Our partners at Frost have recently introduced a GAP enhancement that can increase the value of your GAP offering called the TotalRestart – Loyalty Membership Program.

How it Works

In the event of a total loss, TotalRestart pays up to $4,000 beyond the amount that GAP recovers. When members finance their auto loan through your credit union and purchase GAP coverage, they get the peace of mind of knowing they could get credit toward the replacement cost for a similar vehicle if theirs is damaged or stolen and deemed a total loss. Often times when a credit union finances less than 100% of the vehicle value, it isn’t easy to explain and demonstrate the potential GAP risk that might exist due to unexpected depreciation or poor primary carrier settlement values. Those loans, in particular, will benefit from TotalRestart protection, as the likelihood of receiving a benefit during the term of TotalRestart is even greater when the vehicle is not over-financed. Credit unions offering TotalRestart have also seen an increase in GAP sales. With the inclusion of the current $1,000 GAP Plus benefit, TotalRestart would allow your credit union to offer members up to $5,000 towards their next vehicle financed with you.

TotalRestart helps credit unions to:

- Provide a member benefit that goes beyond just paying off the loan.

- Differentiate your loan and GAP offering by promoting its added value.

- Increase member loyalty after a total loss as the reimbursement benefit is only available toward the financing of a replacement vehicle with YOU.

To learn more about TotalRestart, please complete the contact form below:

Newsletter Signup

CU Insurance Solutions Announces New Partnership with Dale Carnegie Maine

CU Insurance Solutions is proud to announce its new partnership with Dale Carnegie Maine. The partnership will provide our Maine credit union partners with access to a Platinum discount on Dale Carnegie’s core programs. The discount grants a 15% ($300) savings on these powerful training courses:

- The Dale Carnegie Course – A training process that improves company profitability by improving employee performance.

- Dale Carnegie Sales Training – This cutting-edge program trains sales professionals to build relationships that open more doors and encourages lasting client commitment.

- High Impact Presentations – Intensive training that concentrates on delivering a powerful and impactful presentation.

- The Leadership Advantage – This highly concentrated program focuses on primary management functions and communication skills development.

“Our agency is dedicated to providing comprehensive training resources to credit unions through our ongoing CU Insurance Solutions University initiative. We continually strive to provide new content that is dynamic and relevant for our credit union partners. We feel the Dale Carnegie courses will be a very beneficial addition to our yearly curriculum.” – David Baird President/CEO, CU Insurance Solutions

Dale Carnegie has over 9 million graduates and offers programs in over 80 countries and in 35 different languages worldwide. Dale Carnegie graduates work in every industry and nearly every country and include employees from over 400 of the Fortune 500 corporations. The training courses provide practical exercises are used to instill real-world solutions, and participants get the chance to interact in a positive environment. The Dale Carnegie objective is to gently, and persistently, support participants to move out of their comfort zones to achieve goals they have set for themselves.

To learn more about upcoming courses from Dale Carnegie Maine, click on the button below:

Please email CU Insurance Solutions Training Director Randy Judkins at rjudkins@inusrancetrust.us to receive the 15% ($300 savings) registration promo code.

ACA Update – 1095B Tax Form Deadline

It’s tax time again, and we have received several questions about 1095-B forms.

The IRS has extended the deadline for health insurance carriers to provide 1095-B forms is March 2, 2017. However, individuals do not need the 1095-B for group health insurance to file taxes. If you had more than one health insurer during 2016, your employees will receive 1095-Bs from each health insurer.

More information can be found here: Healthcare Information Forms Q & A

Please note that I am not a tax expert, and employees with additional questions should seek advice from a tax professional.

As always, please let me know if you have any questions regarding the Affordable Care Act or employee benefits.

Elizabeth Ingram

Account Manager, Employee Benefits

CU Insurance Solutions

Phone: 800-287-3379 x 312

info@insurancetrust.us

Offsetting Used Vehicle Loan Delinquencies with Auto Loan Protection

Over the past year, credit unions have seen an increasing trend in used vehicle loan delinquencies. In a December 2016 article, S&P Global explained that at the end of the third quarter of 2016, used vehicle loans were the largest delinquent category for credit unions and accounted for $3.70 billion, or 28.41 percent of total delinquencies. As a result of increased delinquencies, charge-offs and vehicle repossessions tend to go hand in hand.

It’s no secret that member vehicle repossessions are a difficult situation for credit unions in many ways. It’s time-consuming, risky in terms of compliance and employees are left to play “auctioneer” to recover lost assets. And in many cases, credit unions take a substantial loss on the loan. These issues have guided many credit unions to seek the solution of Auto Loan Protection to offset the risks of lending competitively.

Auto Loan Protection

Auto Loan Protection is a risk management program that helps credit unions to reduce losses on defaulted loans. The coverage is typically applied by lenders on C, D and E tier loans. The program purchases repossessed vehicles from lenders at higher values than auctions or bids. The program also provides a principal reduction payment to further reduce deficiency balances. In this way, Auto Loan Protection can increase the profitability and yield of your auto loan portfolio.

How It Works

Loan Protection enables credit unions to protect loans by ensuring a predetermined depreciation amount that never changes due to market fluctuation or other factors. The vendor will purchase repossessed vehicles based on guaranteed vehicle values less collision damage, mechanical defects, or excess mileage. Purchase offers are consistently higher than auctions or re-marketers. Credit unions benefit from a 60% to 80% reduction of deficiency balances on repossessed vehicles. The credit union simply defines the member group they wish to apply Auto Loan Protection to while continuing to make all underwriting decisions.

Helping More Members While Protecting Your Portfolio

Finding a solution to help offset costly charge-offs is something that our agency would recommend that all credit unions take advantage of. Regulators and examiners commend credit unions for finding ways to proactively offset charge-offs while approving more loans. The “buy here pay here” and “payday lenders” are steering your members toward high-interest auto loans every day! It’s important to have the ability to offer members with challenged credit a reasonable solution. However, it’s also important to protect your assets and the profitably of your auto loan portfolio to ensure the continued success of your credit union.

To learn more about Auto Loan Protection, please complete the contact form below: