Article by: Tim Dalton EVP CU Insurance Solutions | CUAlliance

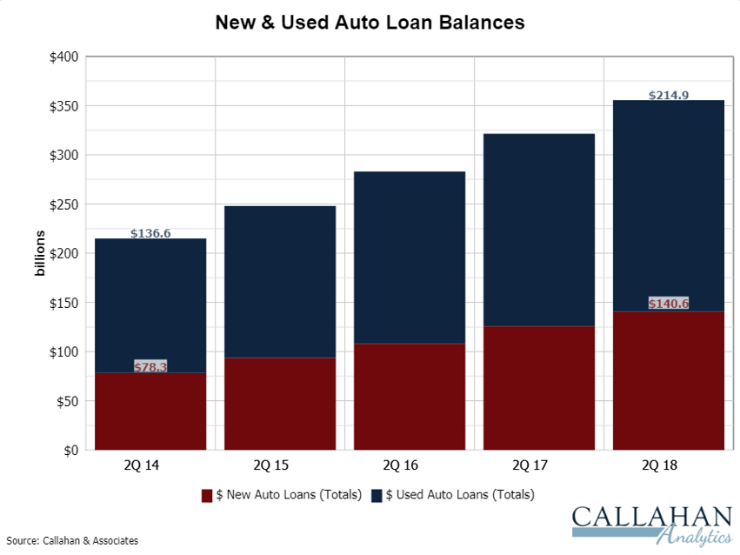

Over the last several years, credit unions have invested an increasing percentage of their loan portfolio in the auto lending market. In fact, within the past four years, credit union new and used auto loan balances have increased 64% nationally.

At the same time, credit unions have been increasing activity with indirect lending programs. Indirect loans now make up 59.6% of the auto lending marketplace nationwide. With 35% of our credit unions holding indirect loans nationally.

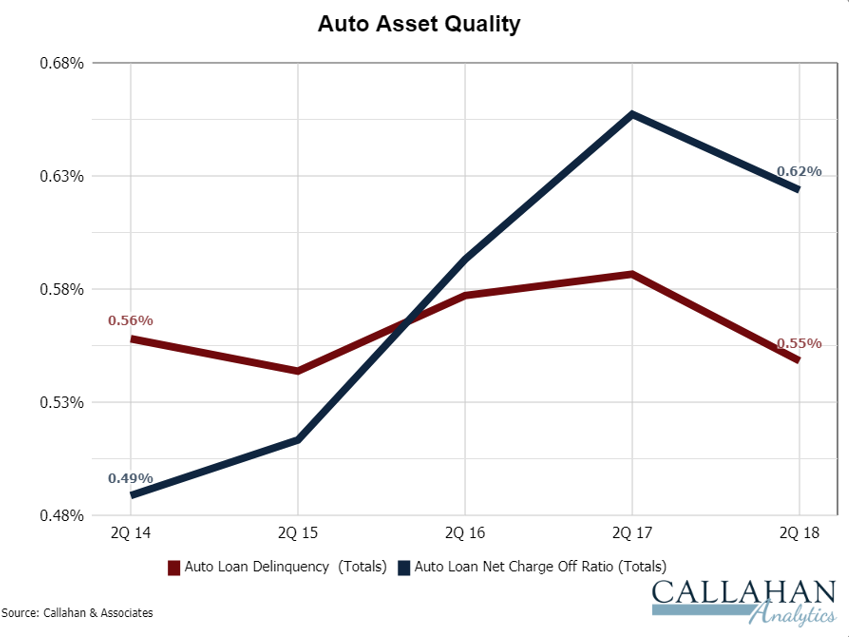

This “Auto Asset Quality” chart below from Callahan Analytics shows credit unions are seeing favorable decreases in delinquency rates by 4 basis points and a decrease in charge-offs by 4 basis points since 2017. These changes can be attributed to several variables. Stronger lending guidelines, loan protection services and better collections process.

This brings us to 2019. According to the consensus forecast from the 2018 Automotive Outlook Symposium (AOS), the growth rate of the U.S. economy is predicted to be above its long-term average in both 2018 and 2019 (though growth next year is anticipated to be moderate). Light vehicle sales are forecasted to decrease from 17.2 million units in 2017 to 17.0 million units in 2018 and decrease to 16.7 million units in 2019.

Not only are light vehicle sales are forecasted to decrease in 2019, but auto industry projections also show all of the major manufacturers are preparing for a change in 2019.

Tom Kontos noted at AOS this year that auction volumes are likely to continue increasing over the coming years chiefly because new vehicle sales reached substantial levels in 2015–17 and these will shortly generate a greater supply of used vehicles. He said he expects the wholesale used vehicle supply to grow 5% on a year-over-year basis in 2018, inducing a 2% to 3% decline in wholesale prices this year. The increasing supply will soften wholesale prices for vehicles.

Analysts at Morgan Stanley are already stating that Automotive sales are “clearly on the downslope post peak,” and “We’ll need more incentives and higher fleet mix just to stand still.” Hoping to create market stabilization with inventory controls.

General Motors has already started to gear down to stave off the impending “fire sales of the past”.

Effect on Credit Union Lending

This type of change in market conditions could have a twofold effect on current outstanding loans in your portfolio:

- A potential devaluation of your current collateral – With a 5% increase in the supply of used vehicles and an expected decline in wholesale vehicle prices, the value of vehicles will likely decrease.

- Member demand or willingness to purchase new vehicles – With less attractive new vehicle sale prices, members will likely keep their vehicles longer or choose to buy used over new in some cases.

Not to be doom and gloom in regards to future auto lending but the proposed question to the CU Insurance Solutions is how do we help protect our clients’ income and assets in what appears to be a declining sector over the coming year. CU Insurance Solutions is dedicated to continually reviewing the conditions of the marketplace and providing tools to help credit unions navigate new challenges in that marketplace as they arise.

It should be noted that Maine has always been a microcosm of difference from the national marketplace. I am not saying we are unaffected by the national mainstream we just lag behind it.

References:

- Callahan Analytics

- 2018 Automotive Outlook Symposium

- Morgan Stanley

- General Motors Corporation