Article by: Heather Baird

Account Manager – Employee Benefits, CU Insurance Solutions

As employee benefits consultants and educators, we receive many questions in relation to Health Savings Accounts (HSA). Here are some common questions, as well as lesser-known facts and misconceptions, you’ll want to be aware of when offering and utilizing an HSA.

First and foremost, if the coverage for an employee’s High Deductible Health Plan (HDHP) is effective any day other than the first of the month (i.e. date of hire- DOH) an HSA cannot be opened until the first day of the following month (i.e. DOH = April 15th– HSA effective date = May 1st).

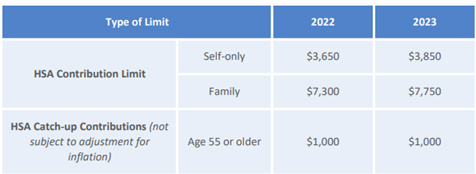

Once an HSA is established, employees will need to determine their contribution amounts. HSA contributions are established annually by the IRS. If an employee and spouse are on two separate HDHP and both contribute towards an HSA, they cannot exceed the combined family maximum. It’s commonly misunderstood that one parent with dependents can contribute the family maximum and the spouse on a single plan can contribute an individual maximum. This is NOT the case. $7,300 is the maximum family limit for a taxable family unit in 2022. This includes all employee and employer contributions. Additionally, if an employee changes employers and plans mid-year and opens a new HSA, their annual maximum contributions will include contributions from all HSAs, not to exceed annual maximums.

That being said, under the last-month rule, if an employee becomes newly eligible on the first day of the last month of his or her tax year (December 1st for most people), they are treated as having the same HDHP coverage for the entire year as is in place on the first day of the last month. This allows employees to contribute the maximum limit. Note, contributions can be made up to April 15th of the following year (applies to all HSAs). If an employee fails to be an eligible individual during the year, they can still make contributions until April 15, for the months they were an eligible individual at the prorated amount.

If an employee decides to take advantage of this rule, they must be aware of the Testing Period. If they fail to remain an eligible enrollee (enrolled in a HDHP) through the subsequent 12 months (i.e. December 1, 2021, through December 31, 2022) they will be subject to a 10% additional tax.

Notes on dependents

An employee’s dependents do not need to be covered under their HDHP to utilize HSA funds. Employees may use HSA funds to pay for medical, dental, and vision costs for taxable dependents not covered under their plans.

So, what if your dependents aren’t taxable? Under the ACA, medical plans must allow dependents up to the age of 26 on the plan, but if a dependent is enrolled under their parent’s HDHP and filing their own taxes, they are not eligible to utilize their parent’s HSA funds. This qualifies a non-taxable dependent to open and contribute to their own HSA. Because the dependent is covered under a family qualified HDHP, they are eligible to contribute the family maximum $7,300 (2022). There are no limits on who can contribute to an HSA, so if a dependent is financially unable to, a parent or loved one can contribute to the account on their behalf post-tax. One important note, the funds in this HSA can only be used for this dependent’s out-of-pocket medical expenses. They cannot use them for any of their spouse or taxable dependents’ costs.

Employees need to keep in mind if they go from Employee + Child or Family coverage to Single coverage mid-year contributions need to be adjusted accordingly.

Medicare and HSAs

As employees near age 65 and Medicare eligibility, they need to be aware of HSA rules. There is a six-month retroactive Part A coverage period. Retroactive coverage in Medicare Part A occurs as follows:

- Enrollment in (premium-free) Part A coverage within six months of turning age 65 will trigger retroactive Part A coverage that is effective the month the employee turns 65. (If the person’s birthday is the first of the month, coverage will start the month before he or she turned 65.)

- Enrollment in (premium-free) Part A more than six months after turning 65 will make Part A coverage retroactive for six months (but no earlier than the month one turns 65).

Employees need to determine in advance when they are going to enroll in Medicare then stop making HSA contributions in the preceding six months.

Also note, starting at age 55 the IRS allows an additional $1,000 annual “catch-up” contribution, and at 65 individuals can withdraw HSA funds for any purpose without penalties, if taken out for expenses other than medical income tax will be applied.

If you have specific HSA questions, we recommend you reach out to your tax advisor for guidance.